Attractive interest rates from 445 pa. 1 Study Loans.

International Student Loans For Malaysian Students In The Us And Canada

Out of the roughly 45 million Americans with federal student loan debt heres who stands to benefit the most from the plan announced Wednesday by President Joe Biden that gives 10000.

. These study loans are repayable through monthly instalments commencing from a month after the study loan cheque is awarded. The OCBC Secured Study Loan SSL is a study loan that is offered alongside a home loan. MARA Study Loan Programme was introduced in 1966 when Majlis Amanah Rakyat MARA was formed.

To better manage your expectations such as high loan margin low-interest rate and fast approval. Education Loan Board Rate plus 045 pa 2. Minimum monthly household income of RM10000.

Apply online and save 200. You must be registered for online banking to complete an online application form. Open to Foundation Certificate Pre-University eg.

Tenure up to 20 years Inclusive of grace period up to 4 years Takaful Coverage is optional. The Education Loan processing fee is. 175 processing fee 1.

Student loans etc which the bank will also consider before approving your applied loan amount. Your monthly repayment or instalment is the fixed amount you have to pay every month for your personal loan. This way they can leverage on their homes equity to fund their childrens education or theirs while having the funds on standby.

Financing is up to RM1 million. Malaysian citizen aged 21 years old and above. RHB Study Loan covers full-time and part-time courses approved by the Ministry of Education and Jabatan Perkhidmatan Awam for both local and overseas education.

Disbursement direct to learning institution. Choose Our Products Online Applications from the top navigation or select Apply for an HSBC personal loan from the banner at the bottom of. As the name suggests a study loan is a loan product offered by a bank for the specific purpose of financing the borrowers education.

Financing of up to RM150000. Rate as low as 399 flat per annum. The best personal loans in Malaysia with interest rates from as low as 399 pa.

On-the-spot approval and disbursement. President Biden outlined his plan to cancel up to 20000 in student loan debt for qualified federal loan holders to give relief to the millions of. As low as RM 4624month.

This non-government linked study loan offers up to. For example if you are borrowing RM10000 and your personal loan interest rate is 5 per annum your annual interest will be RM500. The MARA Loan scheme applies to students who join any private institution for 30 programmes.

Then go to the My Aid tab and search for your loans. 13 hours agoBorrowers eager to know where their FFEL loans are held can go to Studentaidgov and sign in with your FSA ID. Minimum 2 joint applicants with minimum annual income of RM 24000 at.

Relationship of joint borrower with main borrower must be. Up to 7 years tenure. There are 2 loan packages available the minimum coverage is RM20000 and maximum is up to RM500000.

At press time access to. Below there are 2 bank loans options that are most popular among our students. Offers a Secured Study Loan that finances up to 50 of the value of a secured property for a maximum loan.

Per annum means the interest rate will be charged annually. Age is between 21 65 years and not exceeding 70 years at the end of financing period. For joint applications please make an appointment or call us today on 1 441 299 5959.

In Malaysia notable banks that offer some form of study loan include. Our customers will enjoy access to not just one but two products. Maybank may change these terms or suspend or terminate the promotion without giving any notice.

Main borrower student Age 18 to 25 years old non- working student Age 18 to 35 years old working student Joint borrower. And low monthly repayments you can compare and apply online. RM5000 per year for a Diploma course and RM16000 per year for a Degree course.

It is the policy of the FUND that study loan cheques are only made out to the tertiary educational institution where the student is enrolled. Statement of Bank Account copy Repayment Payee Bank Account Sureties IC. A-Level Diploma Degree and Postgraduate program Masters Degree and Doctorates and Professional Courses for students of appointed universitiescolleges.

¹Your education loan application must be approved with a minimum loan quantum of S15000. Minimum fixed monthly Income RM2000.

Icici Education Loan Lowest Interest Rate Options Leverage Edu

Hdfc Education Loan Interest Rate And Its Pros And Cons

Canara Bank Education Loan For Abroad Interest Rate And Documents

Best Education Loan In India For Students Leverage Edu

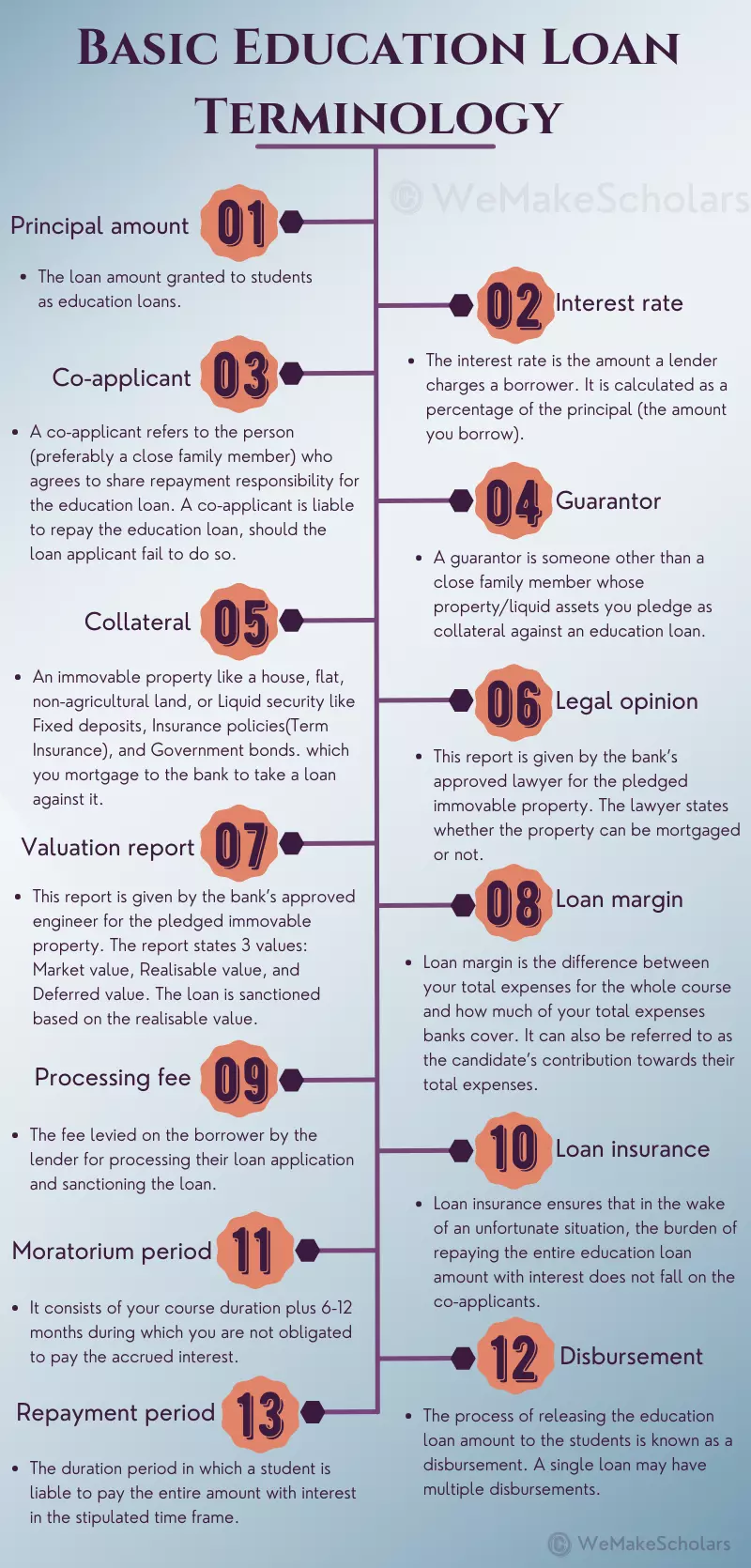

All About Education Loans For Students Leverage Edu

Canara Bank Education Loan For Abroad Interest Rate And Documents

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

Bank Of Baroda Education Loan Procedure Prime University List And Details

Malaysian Banks And Local Institutions Offer Financial Assistance For Customers Affected By Covid 19

Gilman Alumni Are You Searching For An Entrepreneurial Internship Magic Cyberjaya And The U S Internship Program Sustainable Entrepreneurship Human Resources

Bank Of Baroda Education Loan 2021 Documents Form Leverage Edu

Can Students Get An Education Loan For A Medical Program In Malaysia Medical University Medical Education Physics And Mathematics

All About Education Loans For Students Leverage Edu

Education Loan Process For Abroad Study Step By Step Guide 2022

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

Base Rate Br Base Lending Rate Blr Standardised Base Rate Sbr All You Need To Know

A Guide To Car Loans Interest Rates In Malaysia

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information